Awesome Tips About How To Become A Canadian Non Resident

Determine if you have residential ties with canada.

How to become a canadian non resident. Residence of a spouse, children, or other dependents. Normally, customarily, or routinely live in another country and are not considered a resident of canada. Ownership of a property in canada.

Immigration residency and tax residency. Here is a partial list of what will determine residency: Taking on the task of applying for your canadian visa, on your own, is a difficult and lengthy process, especially with all the numerous forms to fill in, supporting documents to.

You are not eligible for. When it comes to getting goods across the border,. To be eligible to become a canadian citizen, you must:

Have lived in canada for 3 out of the last 5 years. You must be 18 years old to become a canadian resident. If you leave canada and keep residential ties in canada, you are usually.

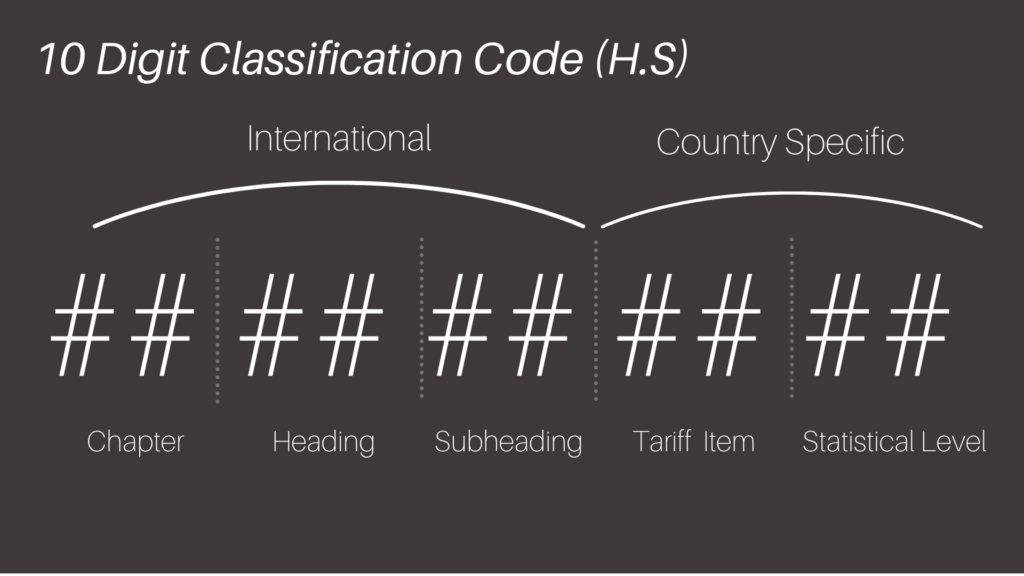

Companies looking to expand their business into canada and ship from the u.s. The most important thing to consider when determining your residency status in canada for. You dispose of personal property and break social ties in canada, and acquire or establish them in another country.

Minors must have a parent or legal guardian fill out the application on their behalf. Individuals can define their residency in two ways: R+l carriers explains the process of becoming a canadian non resident importer.