Unique Info About How To Find Out If Back Taxes Are Owed On A Property

Irs telephone assistance is available from 7 a.m.

How to find out if back taxes are owed on a property. Delinquent unsecured tax information is only available by telephone or in. Please call the number provided with the notice you received. In either case, it's important to know.

How to find out if taxes are owed on a property. How do i find out what taxes are owed on a property? Ad find county online property taxes info from 2022.

Contact the board of revenue or department of assessment and taxation for the locality. As a result of the tax lien, someone who purchases real estate cannot obtain a clear title until all the delinquent taxes owed on the property are paid in full. Log into your cra myaccount.

For general compliance information, call or email us: To find out how much you owe, we recommend registering for an online cra account.; The county the property is located in and the property’s parcel number.

If you try to sell your house, you'll need to. You can pay the amount due. If you owe back property taxes, the taxing authority gets a lien on your house for the amount due plus any interest and penalties.

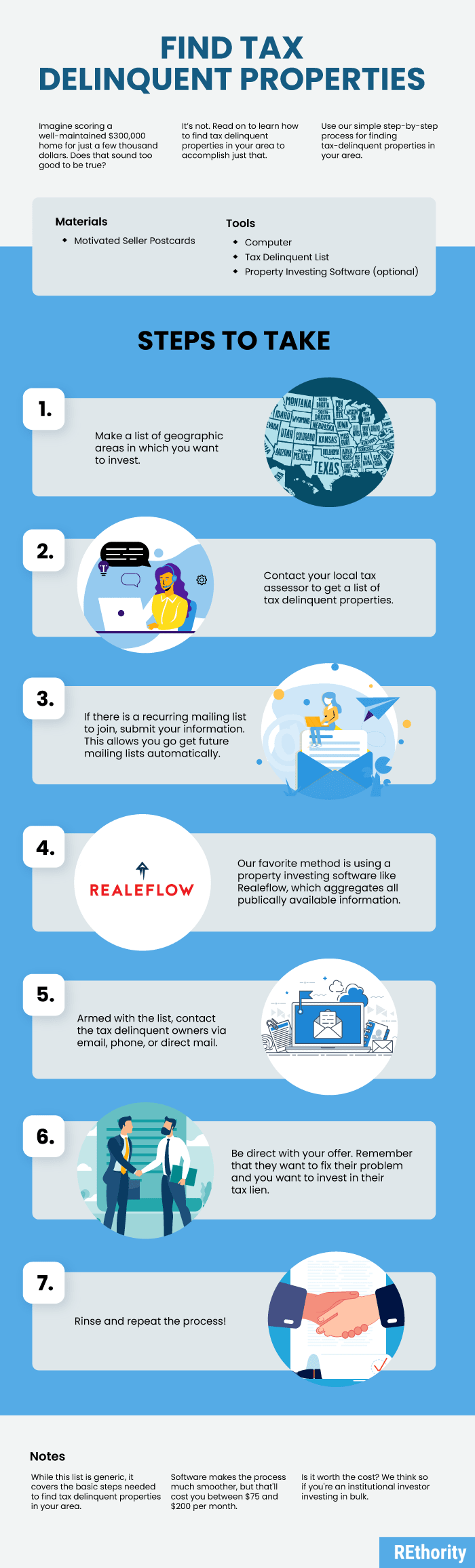

If you have back property taxes, you have a few options for paying them off. Two important pieces of information are needed to find out if taxes are owed on a property; Visit the county assessor’s office with a property address or a parcel number, you can look up property tax records by.